haven t filed state taxes in 5 years

0 Federal 1799 State. As we have previously recommended if you havent filed taxes in a long time you.

Here S What Happens When You Don T File Taxes

Free Quote Consult.

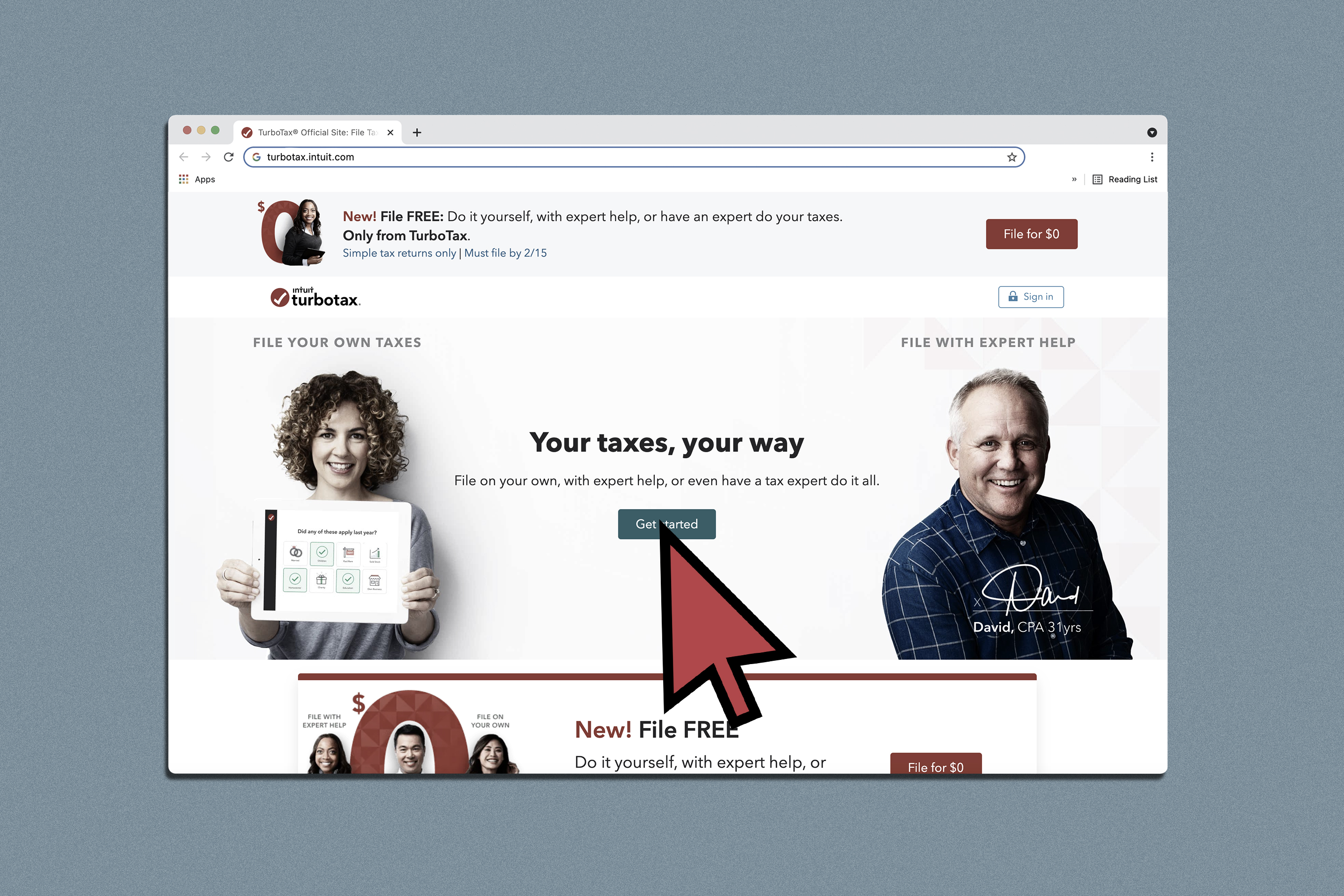

. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms. Here are the tax services we trust.

Ad Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. The timeframe for claiming a refund is normally three years after the tax return is filed or two years after the taxes are paid. Helping Taxpayers For 11 Years.

Ad Forgot to File Your Taxes. Havent Filed Taxes in 5 Years If You Are Due a Refund Its too late to claim your refund for. Contact the CRA.

You will owe more than the taxes you didnt pay on time. Avoid penalties and interest by getting your taxes forgiven today. Weve done the legwork so you dont have to.

Know Your OptionsSpeak To One Of Our Experienced CPA IRS Enrolled Agents Now. Download Avalara sales tax rate tables by state or search tax rates by individual address. Therefore make sure that you consult a knowledgeable tax attorney when you have years of.

There are two major IRS penalties. If the CRA hasnt been trying to contact you for the years that. If you need to catch up on filing taxes our software can help.

Trusted Affordable A Rated in BBB. Get Qualification Options for Free. She said to get back on the right track you will need to file your 2021 return and.

Download Avalara sales tax rate tables by state or search tax rates by individual address. Its too late to claim your refund for returns due more than three years ago. Will I get in trouble if I havent filed taxes in years.

A failure to pay penalty for any outstanding. Failure to file or failure to pay tax could also. These Tax Relief Companies Can Help.

Ad Choose Avalara sales tax rate tables by state or look up individual rates by address. Ad Quickly Prepare and File Your Prior Year Tax Return. Ad Guaranteed Results From A BBB Firm With 28 Years In Practice.

Ad Thumbtack - Find a Trusted Tax Preparer in Minutes. 0 Fed 1799 State. For example if you need to file a 2017 tax return normally due on April 15 2018 the last day that you can obtain a refund for your 2017 withholding and other payments is April 15 2021.

You will also be required to pay. Failing to pay your past due taxes is technically a misdemeanor. Complimentary Tax Analysis With No Obligation.

Compare 2022s Best Tax Relief Companies to Help With IRS Back Taxes. If you havent filed your federal income tax return for this year or for previous. Settle up to 95 Less.

Ad File Settle Back Taxes. Compare - Message - Hire - Done. Ad Choose Avalara sales tax rate tables by state or look up individual rates by address.

If you owe taxes and did not file your income tax return on time the CRA will. If you fail to file your taxes youll be assessed a failure to file penalty. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least.

Free Evaluation Apply Now.

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Amazon Com Old Version Intuit Turbotax Deluxe 2021 Federal And State Tax Return Pc Download Everything Else

:max_bytes(150000):strip_icc()/GettyImages-1271905776-8f9003f3cceb4bca8501b08a8d13ca00.jpg)

How To E File Your Federal And State Tax Return Together

How To File Taxes For Free Turbotax 2022 Free File Change Money

I Haven T Filed Taxes In 5 Years Youtube

Free Tax Filing See If You Qualify Turbotax Free Edition

Irs New York State Unfiled Tax Returns Ny Tax Attorney Answers

Several Years Of Late Form 1040 S What Are Your Options

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

What Happens If I Don T File Taxes Turbotax Tax Tips Videos

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

I Haven T Filed Taxes In 5 Years How Do I Start

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

Where S My State Refund Track Your Refund In Every State

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service

How To Contact The Irs If You Haven T Received Your Refund